Copper is a versatile metal that holds immense investment potential. As one of the most widely used commodities across various industries, investing in copper offers a unique opportunity to capitalize on its growing demand and the ever-evolving market. In this article, we will guide you through the intricacies of investing in copper, covering everything from the benefits and risks to the factors that influence copper prices and the best strategies for successful copper investments.

Key Takeaways:

- Investing in copper allows you to diversify your investment portfolio and tap into the potential of the copper market.

- The demand for copper is constantly increasing due to its widespread use in various industries, including renewable energy and electric vehicles.

- Several investment options are available, such as copper futures, copper ETFs, copper mining stocks, and physical copper.

- However, it is important to be aware of the risks associated with copper investments, including commodity price fluctuations and geopolitical factors.

- Factors such as supply and demand dynamics, economic conditions, currency movements, and geopolitical events significantly impact copper prices.

Table of Contents

Why Invest in Copper?

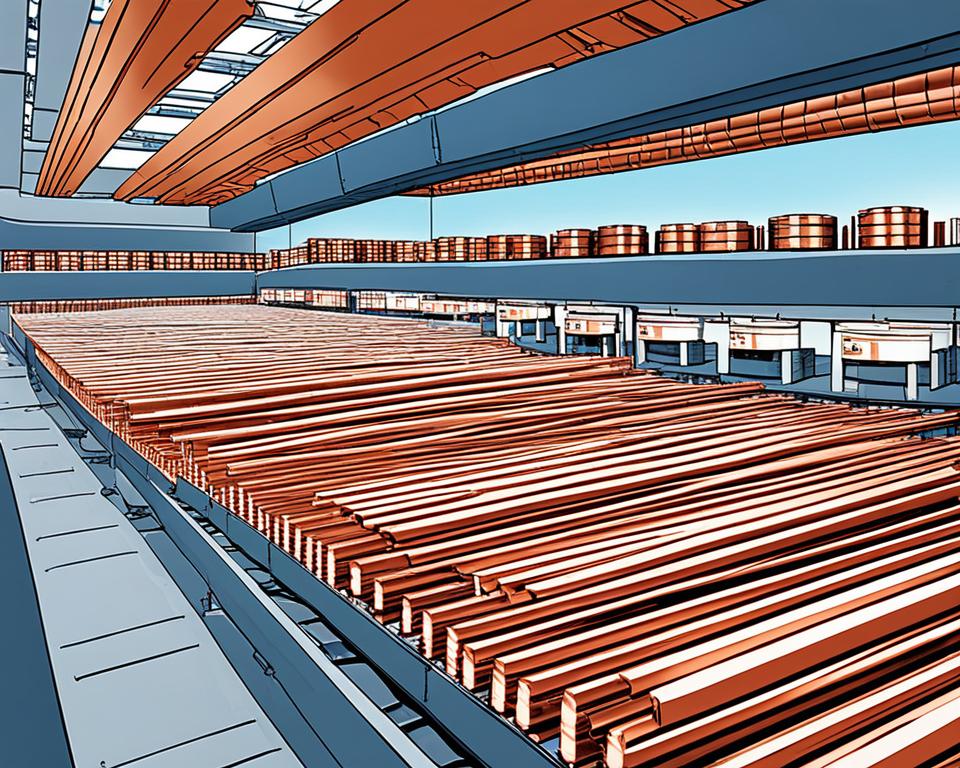

Investing in copper can offer several advantages. Copper is a highly demanded metal with a wide range of industrial applications. The increasing transition to a lower-carbon economy and the growth in sectors like renewable energy and electric vehicles are expected to drive up the demand for copper. Investing in copper can help diversify an investment portfolio and tap into the potential of the copper market.

One of the key reasons to invest in copper is the potential of the copper market. As the world moves towards cleaner energy sources and sustainable technologies, the demand for copper is likely to increase significantly. This presents promising copper investment opportunities for investors.

Furthermore, investing in copper can help diversify your portfolio. Adding commodities like copper to your investment mix can provide a hedge against inflation and reduce overall risk. By including different asset classes, including copper, you can ensure that your portfolio is not overly reliant on a single investment type, therefore enhancing potential returns and reducing volatility.

To summarize, investing in copper presents a compelling case for investors looking to capitalize on the persistent demand for this versatile metal in diverse sectors. Not only does it offer copper investment opportunities, but it also allows you to diversify your portfolio and tap into the potential of the copper market.

How to Invest in Copper

When it comes to investing in copper, there are several options available that cater to different investment preferences. Here, we will explore some of the key investment vehicles for gaining exposure to the copper market.

Copper Futures

One way to invest in copper is through copper futures contracts. These contracts allow investors to buy and sell copper at a predetermined price and date in the future. By trading futures, investors can speculate on the price movements of copper without needing to directly own physical copper. Copper futures offer flexibility and the potential for significant returns, but they also carry a higher level of risk and require a good understanding of the futures market.

Copper ETFs

For investors seeking a more diversified approach to investing in copper, copper exchange-traded funds (ETFs) are an option worth considering. Copper ETFs are investment funds that trade on stock exchanges like regular stocks. They provide exposure to copper prices without the need to physically own or store the metal. Copper ETFs offer the advantage of liquidity, allowing investors to buy and sell shares easily. These funds often track the performance of copper through various financial instruments such as futures contracts and derivatives.

Copper Mining Stocks

Investing in copper mining stocks is another way to gain exposure to the copper market. By investing in mining companies that extract and produce copper, investors can tap into the potential profits generated by the rising demand for copper. These stocks offer the opportunity to benefit from both the commodity price of copper and the company’s operational performance. However, investing in copper mining stocks carries specific risks associated with the mining industry, such as operational challenges, geopolitical factors, and fluctuating commodity prices.

Physical Copper

For those who prefer a tangible asset, investing in physical copper is an option to consider. This involves purchasing physical copper such as bars or coins and storing them securely. While investing in physical copper allows for direct ownership of the metal, it requires knowledge of storage, transportation, and insurance arrangements. It is important to note that physical copper investments may involve additional costs and considerations.

Each investment option has its own advantages and considerations. It’s essential for investors to conduct thorough research, assess their risk tolerance, and seek professional advice before making any investment decisions in the copper market.

Investing in copper provides opportunities to diversify portfolios, tap into the potential of the copper market, and benefit from the increasing demand for this versatile metal. Whether through futures contracts, ETFs, mining stocks, or physical copper, investors have various avenues to participate in the copper market. As with any investment, it is important to carefully evaluate the risks and potential rewards associated with investing in copper.

Risks of Investing in Copper

Investing in copper can be a lucrative opportunity, but it’s important to be aware of the risks involved. Like any investment, copper carries its own set of challenges that investors need to consider. Understanding these risks is crucial to making informed decisions and managing your portfolio effectively.

Commodity Price Risk

Copper prices are highly volatile and can fluctuate significantly due to various factors. Global supply and demand dynamics, economic conditions, and geopolitical events can all impact copper prices. It’s important to closely monitor these factors and stay updated on market trends to mitigate the risk of price volatility.

Currency Risk

Copper is traded internationally in U.S. dollars, which exposes investors to currency risk. Exchange rate fluctuations can influence the value of investments in copper, especially for investors outside the United States. It’s essential to consider the potential impact of currency movements on your investment returns.

Mining Risks

Investing in copper mining stocks comes with its own set of risks. Geopolitical instability in mining regions can disrupt production and impact the profitability of mining companies. Fluctuating commodity prices also affect mining stocks, as they can directly impact revenues and profitability. Operational risks, such as equipment failures or accidents, further add to the risk profile of investing in mining companies.

Geopolitical Risk

Geopolitical events and conflicts can have a significant impact on copper prices and investments. Political instability or trade disputes in major copper-producing regions can disrupt supply chains and lead to volatility in copper prices. It’s crucial to stay informed about geopolitical developments and assess their potential impact on copper investments.

Environmental Risk

Copper mining and production have environmental implications and risks that investors should be aware of. Environmental regulations and concerns related to carbon emissions and pollution can impact the operations and reputation of mining companies. Investors should consider the sustainability and environmental practices of mining companies before making investment decisions.

Factors Affecting Copper Prices

Several factors can influence the price of copper. Understanding these factors is crucial for investors looking to make informed decisions in the copper market.

1. Supply and Demand Dynamics

The primary driver of copper prices is the balance between supply and demand. When demand for copper is high and supply is limited, prices tend to rise. Conversely, when demand is low and supply is abundant, prices tend to decline. Factors such as industrial production, construction activity, and technological advancements can impact the demand for copper.

2. Economic Conditions

Economic conditions, both globally and domestically, play a significant role in copper price movements. Changes in economic growth rates can affect the demand for copper, particularly in sectors such as manufacturing, infrastructure development, and consumer electronics. Economic indicators such as GDP growth, inflation, and employment rates can provide insights into the overall health of the economy and its potential impact on copper prices.

3. Currency Movements

Copper is internationally traded in U.S. dollars. Therefore, fluctuations in currency exchange rates between the U.S. dollar and other currencies can impact copper prices. When the U.S. dollar strengthens against other currencies, it can make copper more expensive for buyers using those currencies, potentially reducing demand and putting downward pressure on prices. Conversely, a weaker U.S. dollar can make copper more affordable, increasing demand and potentially driving prices higher.

4. Geopolitical Events

Geopolitical events, such as trade disputes, political tensions, and policy changes, can have a profound impact on copper prices. Government policies relating to international trade, tariffs, and regulations can affect copper imports and exports, influencing supply and demand dynamics. Additionally, political instability or conflicts in major copper-producing regions can disrupt production and transportation, leading to potential supply shortages and price volatility.

5. Natural Disasters

Natural disasters, such as earthquakes, hurricanes, and floods, can disrupt copper mining operations and cause supply disruptions. These events can damage infrastructure, interrupt transportation routes, and impact power supply, leading to reduced production and increased costs. Additionally, natural disasters can also affect demand for copper, especially in industries such as construction and infrastructure development, which may require reconstruction efforts.

In summary, a combination of supply and demand dynamics, economic conditions, currency movements, geopolitical events, and natural disasters can significantly impact copper prices. To make informed investment decisions in the copper market, it is crucial for investors to closely monitor these factors and their potential effects on the future outlook of the metal.

| Factors | Influence on Copper Prices |

|---|---|

| Supply and Demand Dynamics | Primary driver of copper prices; high demand and limited supply lead to price increases, while low demand and abundant supply result in price declines. |

| Economic Conditions | Changes in economic growth rates and indicators impact copper demand from various sectors. |

| Currency Movements | Fluctuations in currency exchange rates affect the affordability of copper for international buyers. |

| Geopolitical Events | Trade disputes, political tensions, and policy changes can influence copper supply and demand. |

| Natural Disasters | Disruptions in copper mining operations caused by natural disasters impact supply and production. |

Note: The table above provides a concise summary of the factors affecting copper prices.

Best Copper Stocks to Invest In

If you’re looking to gain exposure to the copper market, investing in copper mining companies can be a lucrative option. These companies are involved in the exploration, extraction, and production of copper, making them well-positioned to benefit from the demand for this versatile metal.

Here are some of the top copper stocks to consider:

| Company | Stock Ticker |

|---|---|

| Freeport-McMoRan Inc | FCX |

| BHP Group Ltd | BHP |

| Rio Tinto Group | RIO |

| Anglo American plc | NGLOY |

| Southern Copper Corporation | SCCO |

Before making any investment decisions, it’s important to conduct thorough research on these companies. Analyze their financial performance, management team, and industry trends to make informed investment choices. Keep in mind that investing in stocks involves risks, and past performance is not indicative of future results.

Conclusion

Investing in copper presents exciting opportunities for investors looking to diversify their portfolios and capitalize on the potential of the copper market. With its versatile applications across various industries, copper continues to be in high demand. Furthermore, the transition towards a lower-carbon economy, coupled with the growing adoption of renewable energy sources and electric vehicles, further fuels the potential for the copper market’s growth.

However, it is important to approach copper investments with caution and diligence. Like any investment, there are risks involved. Copper prices can be volatile, influenced by factors such as global supply and demand, economic conditions, and geopolitical events. Additionally, investing in copper mining stocks carries its own set of risks, including geopolitical instability, fluctuating commodity prices, and environmental concerns.

For those considering investing in the copper market, seeking professional financial advice is essential. By consulting with experts who are well-versed in the intricacies of the copper market, investors can make informed decisions that align with their financial goals and risk tolerance. Conducting thorough research on copper mining companies, analyzing their financial performance, management team, and industry trends, can also help ensure a well-informed investment strategy.